Taxpayers Get No Discount from Pension Investments

Question: Is Tiverton’s police pension doing OK?

Reading through the plans that Rhode Island cities and towns have put together to address their massive pension debts, one gets the impression that hiding the size of the problem from taxpayers is the goal that drives every decision.

Chief among the deceptions is the discount rate. Basically, the discount rate is what the town assumes it will earn on its investments from the pension fund each year. In Tiverton, that number is 7.5%. So, when the town’s actuaries run the numbers at the end of the fiscal year to tell us how our pension fund is doing, they “discount” what we actually owe to retirees and employees by that much.

Say we owe a retired policeman $10,000 next year. A 7.5% discount rate means we need about $9,300 invested this year to completely cover the expense when it’s due. If we owe that $10,000 in ten years, the actuary would tell us we only need about $4,850 in the bank right now. If we only had $2,900, the actuary would tell us not to worry, because we’re 60% funded. This is how they make taxpayers feel OK that politicians have promised employees money that the town doesn’t have.

The problem is that 7.5% is a very high return to hit every year. According to the latest actuarial report, Tiverton’s pension fund lost $332,601 last year, which is about -3.4%. In other words, because we needed a 7.5% increase, we were 10.9% short. Tiverton should have started this year with another $1,065,971 or so in the bank.

Investment professionals will tell you not to panic, because we have to expect the market to go up and down, and what’s important is the average over years and decades. One bad year is not the end of the world, and during the three years prior to this loss, Tiverton beat its 7.5% every year.

Two things make this picture too bright. The first is that 0% isn’t the break-even number in this calculation — 7.5% is — which means every loss is huge and every gain is smaller than it seems. The second is that coming up short one year means there’s less in the bank to invest the next year, so the gain the next year has to be even bigger.

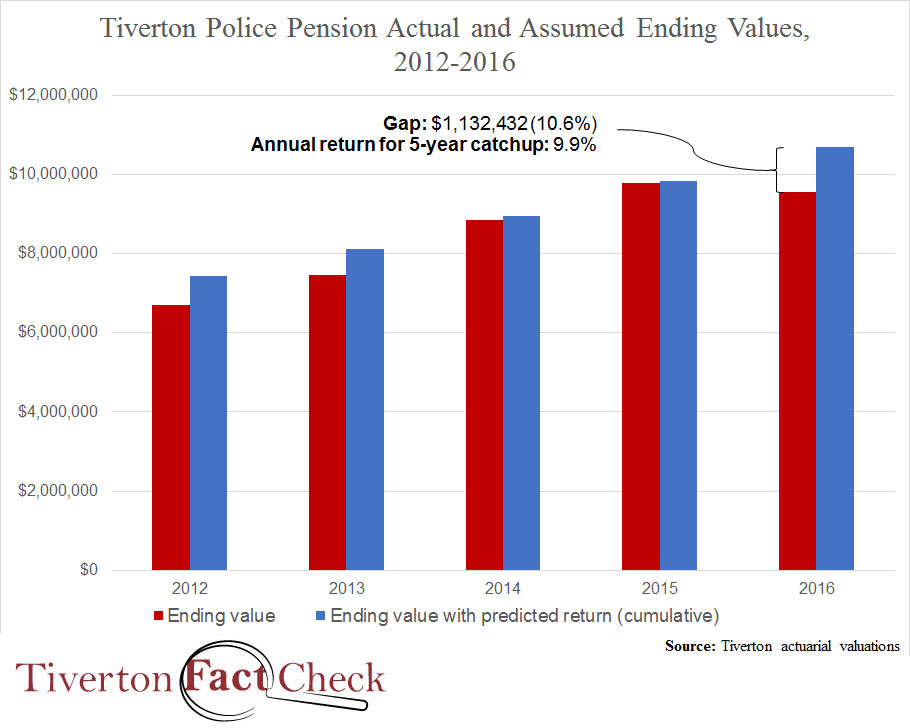

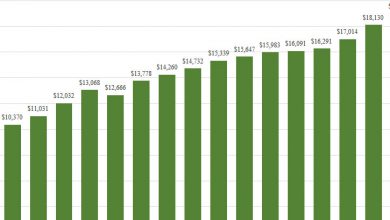

The following chart shows the actual value of Tiverton’s pension fund every year for the past five as the red columns and the value it should have had as the blue columns. Tiverton is $1,132,432 short of where the actuaries said in 2012 we’d be now, and our investment managers will have to get us a 9.9% profit every year for the next five to catch us up.

That means 9.9% is now break-even, and any year that comes up short of that return is actually a loss. Simply put, 9.9% for five straight years isn’t going to happen, and the accounting for our police pension is a fiction.

Next time, I’ll explain how government officials think your bank account makes their deception just fine.

One Comment